How to Trick Your Brain into Banishing Bad Money Habits and Emotional Spending

Do you have difficulties resolving financial issues?? Do not worry much about it as scientists have discovered the reason behind bad money habits. Everyone can now focus on managing their spending with a simple step, which has got to do with ‘self-control’. It’s not that hard, isn’t it?

The main issue with us is that we tend to buy things, which we do not need. This happens when we get emotionally attached to something, which looks tempting, or something which can convince us to make us feel good about ourselves, prevents us from getting bored, help us to attract to the opposite sex, and you name it.

STOP SPENDING!

The common problem most of us face:

Most of us have the tendency of making a purchase as soon as we see the product in-store whether it's brick-and-mortar or online. If you find yourself wanting to buy something right after you see the product, it is always better to wait for 24-hours before you make the purchase as it will trigger your conscious mind and enable you to think rationally regarding the benefits of the particular product.

If you find too much money in your pocket, immediately put half of it away in a safe place and avoid using it unless in case of emergency and the other half can be used for daily expenses. BUT if you overdo it, there is a tendency of you running out of money, and you will end up spending all the money which you were saving and leave you back to where you started from.

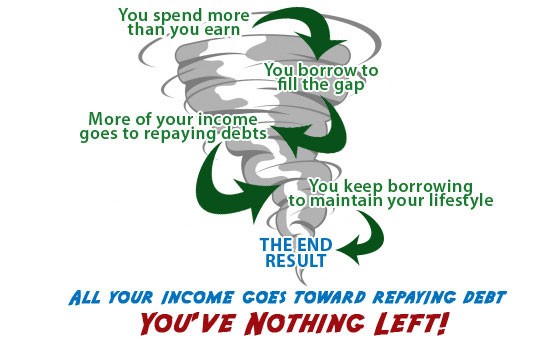

Most of us spend too much money and not realizing it until it's too late. So, to create consciousness, just record all your daily expenses in a book, your phone or your laptop. You need to create a habit of recording all your expenses from a cup of coffee to purchasing a new car. Be honest with yourself and do not cheat by not listing down something which you feel you should not have. This financial diary will not only improve your daily purchases but also improve yourself to live a better life or a ‘debtless’ life.

“Develop your financial planning. When finances come into the picture, “winging it” just isn’t an option. The reason many of us fail at banishing bad money habits is simply that we didn’t have a firm and realistic goal, to begin with”.