China Sunsine’s 1H2022 net profit records 61% growth to a new high of RMB427.5mil! Let us discover on what are the future prospect of this company!

Background

China Sunsine Chemical Holdings Ltd is a leading specialty chemical producer. It is the largest producer of rubber accelerators in the world and the largest rubber chemicals enterprise in the People’s Republic of China. The group’s production facilities are located at Shanxian, Weifang and Dingtao in Shandong Province, the PRC. The group’s total production capacity is currently 222,000 tonnes per annum, comprising 117,000 tonnes of rubber accelerators, 60,000 tonnes of insoluble Sulphur and 45,000 tonnes of anti-oxidant.

As a chemical producer serving its global customers, China Sunsine continuously improves its manufacturing and environmental protection capabilities. China Sunsine’s wholly-owned subsidiary, Shandong Sunsine Chemical was listed in the first batch of Champion Manufacturing Enterprise by the Ministry of Industry and Information Technology of China in Jan 2017. China Sunsine was listed on the Main Board of the Singapore Exchange Securities Trading Limited on 5 July 2007.

Business Model

China Sunsine Chemical Holdings Ltd has a centralized heating plant at Shanxian which generates steams and electricity. The group’s products sold under the “Sunsine” brand (accredited as “Shandong Province Famous Brand”). The group’s customers are mainly the tire companies which rely on the automobile industry. The group has over 1,000 customers around the world and continues to serve more than 2/3 of the Global Top 75 tire makers, such as Bridgestone, Michelin, Goodyear, Pirelli, Sumitomo, Yokohama, Hankook, Cooper, Kumho Tires, as well as PRC tire giants such as Hangzhou Zhongce, GITI Tire, Shanghai Double Coin Tyre etc.

Management Background

Executive Chairman – Xu Cheng Qiu

Xu Cheng Qiu (徐承秋) is the Executive Chairman of China Sunsine Chemical Holdings, responsible for the overall management, formulation and implementation of its business strategies. He has more than 30 years of experience in the rubber chemical industry. He joined the group in 1977, when the predecessor of the subsidiary Shanxian Chemical, was first established. In Dec 1998, Mr Xu, together with other employees, executed an MBO and he became the Executive Chairman and General Manager of Shanxian Chemical. He was also honored with numerous awards, amongst them “Outstanding Entrepreneur” award, from the Heze City Economic and Trade Committee and “Excellent Leader in Technological Innovation” by China Rubber Industry Association (CRIA). Mr Xu is part of a group of Chairpersons spearheading the various committees of CRIA. He obtained his degree in Rubber Chemical Engineering from Shandong Chemical College in 1966 and became a qualified senior engineer in 1989.

China Sunsine’s 1H2022 net profit records 61% growth to a new high of RMB427.5mil

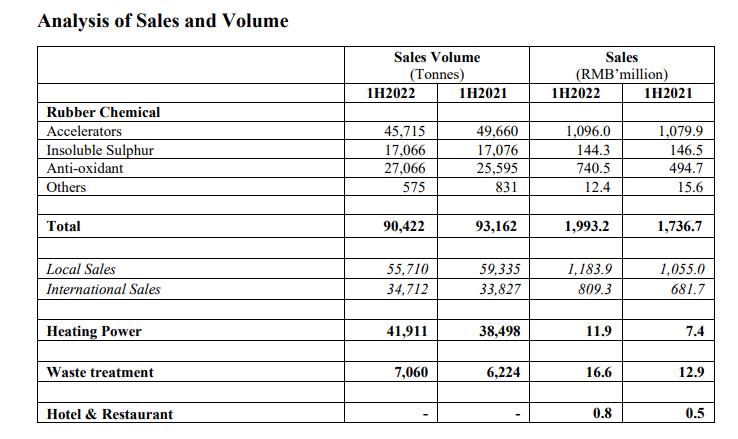

In the 1H2022, the increase in global commodities prices have led to an increase in the prices of their raw materials, and the group was able to pass on such increase to its customers. As such, the group’s revenue in 1H2022 grew by 15% to RMB2,022.5mil, compared to RMB1,757.5mil in 1H2021, which was mainly due to the higher ASP, partially offset by a lower sales volume.

ASP increased by 18% to RMB22,043 per tonne in 1H2022 from RMB18,642 per tonne in 1H2021.The group’s sales volume declined slightly by 3% from 93,162 tonnes in 1H2021 to 90,422 tonnes. A few factors had adversely impacted the sales volume in 1H2022: Chinese New Year holidays, tentative supply chain interruption during Winter Olympic Games, and Covid-19 control measures implemented in some affected areas in China.

Gross profit lifted 26% from RMB552.3mil in 1H2021 to RMB694mil in 1H2022, and gross profit margin enlarged by 2.9% points from 31.4% to 34.3%. As a result, profit before tax rose by 30% from RMB360.7mil in 1H2021 to RMB470.1mil in 1H2022.

The group’s main subsidiary, Shandong Sunsine, received a formal letter of approval confirming its “High-tech Enterprise” status in May 2022, which entitles its subsidiary to a concessionary tax rate of 15% for 3 years with effect from 1 Jan 2021. Therefore, Shandong Sunsine received a refund of approximately RMB36.1mil from the local tax authority during 1H2022 for the overpayment of tax expenses for FY2021. As a result, the group’s net profit for 1H2022 surged 61% to RMB427.5mil from RMB265.2mil in the corresponding period of last year. Excluding a one-off RMB36.1 mil refund of over payment of FY2021 tax expenses, Sunsine’s 1H2022 core net profit came in at RMB391mil (+48% yoy).

In 1H2022, sales volume for Accelerators decreased by 8% due to weak domestic demand and intensified competition. Its product sales volume remained stable, whereas sales volume of Anti-oxidant products increased by 6% as the new 30,000 tonne TMQ production line was put into commercial production.

Sales volume in China’s domestic market dropped by 6% due to the combined effects mentioned above, whilst international sales grew by 3% as the global economy was recovering gradually from the Covid-19 pandemic.

The group’s financial position remains healthy and robust with strong cash balances of RMB1,206.4mil and no debt. Based on its latest 6-months’ results, the group’s earnings per share was 44.06 RMB cents (or 9.15 SGD cents) and its net assets per share amounted to 361.99 RMB cents (or 75.15 SGD cents) for 1H2022.

In view of the good results achieved in 1H2022 and in celebration of the company’s 15th anniversary of its listing on Singapore Exchange, the Board is pleased to declare a special one-tier tax exempt dividend of 0.5 Singapore cents per ordinary share.

Future Prospect

According to the Chairman Mr Xu Cheng Qiu, the group’s performance remained resilient in the 1H2022 demonstrated the strength of their market leadership position, even though the group was facing various challenges such as volatilities of raw materials prices, low utilization rate of tyre manufacturers and intense competition in the rubber chemicals industry.

However, in the 2H2022, the group does not foresee any improvement in the overall operating environment. Conversely, the group expects the challenges to remain or worsen due to the high inflation rate, greater geopolitical tension, weakening economic growth in China, as well as the uncertainties of and restrictive measures arising from the Covid-19 pandemic situation.

Despite the headwinds, the groups are well placed to face the difficulties. They strongly believe the capacity expansion will enhance their competitive advantage and further increases their market share. He mentioned that the 2 new projects have commenced commercial production in 1H2022.

The group will continue to implement its strategy of “sales production equilibrium”. The management remains confident about the group’s profitability in the next 12 months, supported by strong balance sheet and financial stability, market leadership position, ability to provide high-quality products, economies of scale, a variety of chemical products, and compliance with national environmental protection laws and regulations.

According to sci99.com, a Chinese commodity market information service provider, rubber accelerator prices remained relatively stable on a mom basis in Jun/July, while aniline prices eased slightly. As Sunsine typically locks in the quarterly pricing of its rubber accelerator products with major customers (while taking spot prices for raw materials), we believe its near-term gross profit spread is likely to remain healthy in 3Q2022.

Expansion Project Update

1. Phase 1, 30,000-tonne per annum IS project

Commercial production has commenced in Dec 2021.

2. 30,000-tonne per annum Anti-oxidant TMQ and 2,000-tonne HTMQ project

We have obtained approval to start commercial production in 1H2022.

3. Controlled Landfill Projects

The construction of the main body work of Phase 2 of 50,000-tonne capacity has been completed, and is undergoing auxiliary work. The project is expected to be completed by the end of 2022.

Fundamental Analysis

Market Cap: 455.15mil

Number of Shares: 968,400,000

PE Ratio: 4.248

EPS (SGD): 0.11065

Dividend Yield: 2.129%

Return on Equity: 19.324%

Net Earnings Growth: 68.951%

Technical Analysis

Resistance Level: SGD0.545, SGD0.510

Support Level: SGD0.450, SGD0.430

Based on the stock weekly chart of China Sunsine Chemical (QES), QES has formed a downtrend channel since last May. However, QES recently showed a reversal and broke the channel right after the last quarter’s results. QES must remain above the SGD0.450 support price level in order for the price to continue rising. The next important resistance level to pay attention to is SGD0.51. If the price breakout happens and sustains at this price level of SGD0.51, it might be a good indication that QES is showing a bullish trend and might rally towards the next resistance level of SGD0.545.

![]() Please like and follow our FB page to get more updates from us. Thank you.

Please like and follow our FB page to get more updates from us. Thank you. ![]()

![]() 𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

The research, information and opinion expressed in this article / video are purely for information and educational purpose only and should not be construed as investment advice. We will not be liable for any losses or damages suffered from your investment decisions. Kindly consult a licensed investment advisor if you wish to get any investment advice.

![]() Open a Stock / Futures trading account in Malaysia: https://bit.ly/3dX157y

Open a Stock / Futures trading account in Malaysia: https://bit.ly/3dX157y

🍁 Facebook: https://www.facebook.com/mywealthfort

🍁 Instagram: https://www.instagram.com/mywealthfort/

🍁 Telegram: https://t.me/mywealthfort

🍁 YouTube: https://www.youtube.com/lifechamp

🍁 Website: https://www.mywealthfort.com/

More articles…