Background

Kimly Limited 金味有限公司 was incorporated on 23 May 2016 and it is one of the largest traditional coffeeshop operators in Singapore with 30 years of experience. The group operates and manages an extensive network of 85 food outlets, 164 food stalls, 11 Tonkichi and Tenderfresh restaurants, 7 Rive Gauche Patisserie shops and 3 Tenderfresh kiosks across the heartlands of Singapore. It also operates Central Kitchen that supplies sauces, marinades and semi-finished food products to its food stalls, which enables it to have better control over its business processes and generate cost savings. The Tenderfresh Central Kitchen also engaged in manufacturing, processing and sale of food products to other customers island wide.

Business Model

The principal activities of KIMLY consists of business of investment holding, provision of management services, letting and operating of coffee shop, operating of restaurant and confectionary shop, manufacturing, processing and sale of food products and provision of cleaning services.

Its food Retail Division comprises Mixed Vegetable Rice, Teochew Porridge, Dim Sum, Seafood “Zi Char”, Japanese Food, Western Food and confectionery shops operates within the group’s coffeeshops, third party brand’s coffeeshops, food courts, F&B kiosks and full-service restaurants. These food products are also available for online ordering through multiple delivery platforms.

Management Background

As Executive Chairman, Mr Lim had founded Kimly with friends back in 1990. The company has since grown to become one of Singapore’s largest coffee shop chains. However, in Feb 2022, two former directors of Kimly were fined for their role in failing to notify the Singapore Exchange that Kimly’s acquisition of drinks company Asian Story Corporation involved a conflict of interest.

Former executive chairman Lim Hee Liat was fined $150,000 and disqualified from acting as a director of any company for 5 years. The former executive director Chia Cher Khiang was fined $100,000 and also handed the same disqualification. Lim and Chia were each charged under the Securities and Futures Act with one count of failing to notify the SGX that Kimly’s acquisition of ASC was an interested person transaction. Lim was also charged under the Companies Act for failing to disclose that SCD was a company that was partially beneficially owned by him.

Mr Lau Chin Huat, Non-Executive Independent Chairman, Chairman of the Nominating Committee, and a Member of the Audit and Remuneration Committees

Mr Lau Chin Huat was appointed as Kimly’s Independent Director since 1 Oct 2019. On 11 Nov 2021, he assumed the position of Non-Executive Independent Chairman of the Board,

Mr Lau has over 35 years of audit, accounting, tax and advisory experience and is currently a Public Accountant, Licensed Insolvency Practitioner, ISCA Financial Forensic Professional, Accredited Tax Practitioner (Income Tax) and Accredited Tax Advisor (GST).

Mr Lau is registered as a Professional Deputy (Personal Welfare and Property & Affairs) by the Office of the Public Guardian. He graduated from the National University of Singapore with a Bachelor of Accountancy degree. Mr Lau is a fellow member of Institute of Singapore Chartered Accountants (ISCA), member of Certified Public Accountants of Australia (CPA Australia) and Singapore Chartered Tax Professionals. He is also a Fellow member of The Singapore Institute of Arbitrators.

Kimly registered a net profit of S$18.5mil in 1H FY2022

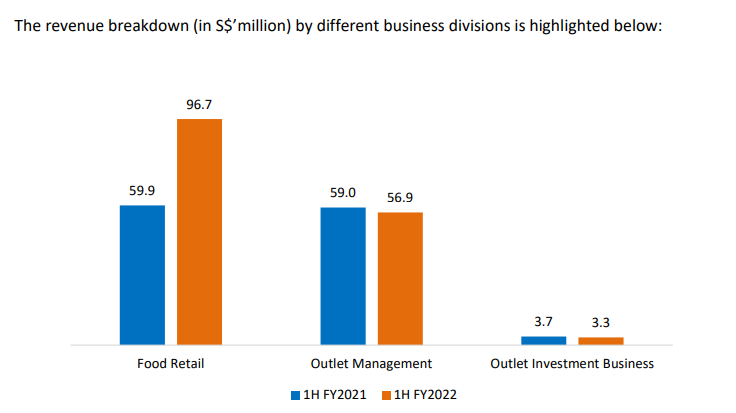

Kimly reported a 27.9% year-on-year (YoY) increase in revenue to S$156.9mil for the half year ended 31 Mar 2022 (1HFY2022), mainly due to revenue growth in Food Retail division. The group also registered net profit after tax attributable to the owners of the Company of S$18.5mil for 1H FY2022, a decrease of 14.7% YoY.

The Food Retail Division which is the largest contributor to the Group’s revenue recorded an increase of S$36.8mil to S$96.7mil in 1H FY2022. The increase was mainly due to revenue contributions from the newly acquired Tenderfresh Business in Oct 2021, offset by a decrease in revenue contribution following the closure of 12 underperforming food stalls due largely to manpower shortage. However, the growth in revenue was offset by lower revenue contribution of S$2.2mil and S$0.4mil from Outlet Management Division and Outlet Investment Business Division respectively. This was attributable to the decrease in sale of beverages and tobacco products, arising from lower footfall at most of the Group’s coffeeshops due to Covid-19 restrictions imposed in view of rising cases. The Group only allowed a group of up to two to dine in as it was relatively challenging to enhance vaccine differentiated controls in coffeeshop setting.

In line with the growth in revenue, cost of sale increased by to S$26.8mil to S$109.1mil in 1H FY2022. The increase in cost of sales was in line with the increase in revenue. Cost of sales as a percentage of revenue increased from 67.1% in 1H FY2021 to 69.6% in 1H FY2022. This was mainly driven by lower government grants, higher utilities charges which was in line with the rise in electricity tariff, higher employee benefits by Klovex in providing the cleaning services and increase in depreciation of right of use assets. As a result, the Group registered a 18.5% growth in gross profit to S$47.8mil in 1H FY2022 and the gross profit margin decreased by 2.5% to 30.4% in 1H FY2022.

Selling and distribution expenses increased by S$5.7mil to S$10.5mil in 1H FY2022 was mainly attributable to higher online food delivery fees and packing materials expenses from the newly acquired Tenderfresh Business.

The Group also recorded a S$3 mil increase in administrative expenses to S$12.5mil in 1HFY2022. This was due to repair and maintenance, bank charges, depreciation of property, plant and equipment, insurance, rental and general charges of S$1.6mil incurred by the newly acquired Tenderfresh Business; higher depreciation of right-of-use assets of S$0.5mil, lower government grants of S$0.5mil for wage support, higher repair and maintenance charges of S$0.2mil and higher depreciation of property, plant and equipment of S$0.1mil.

As a result of the above, profit attributable to the owners of the Company decreased from S$21.7mil in 1H FY2021 to S$18.5mil in 1H FY2022. The Group generated S$40.4mil in net cash from operating activities in 1H FY2022 as compared to S$46.6mil in 1H FY2021. As at 31 Mar 2022, the Group had S$65.2mil in cash and cash equivalents (30 Sep 2021: S$95mil).

The Group has declared an interim dividend of 0.56 Singapore cents per share to thank all the shareholders and show appreciations for their unwavering support and continued loyalty.

The operating environment in the Food and Beverages industry is expected to remain challenging as the local F&B players are facing mounting operating cost pressures brought by the ongoing manpower crunch due to tightening of foreign manpower policy and rising costs of raw materials, rental and utilities. Intensifying competition has also further exacerbated the situation.

There will no longer be limits on group sizes or a requirement for safe distancing from 26 Apr 2022 as Singapore moves to further ease Covid-19 measures. All employees may also return to the workplace where working from home will no longer be the default. Lower footfall to the Group’s food outlets could be expected following the lifting of the restrictions as the Group’s coffeeshops are predominantly located within the heartlands. In addition, demand for food delivery services may taper as more people are expected to dine in at F&B establishment. Nonetheless, the Group will continue reinvent, innovate and upgrade its menu offerings to appeal to its patrons.

The acquisition of the Tenderfresh Business will propel the Food Retail division forward and generate new revenue streams for the Group. In addition, Tenderfresh Business’ competitive edge and extensive network in the Halal food market allows the Group to make further inroads into the Halal food segment. Following the reopening of the second Kedai Kopi outlet and the third Tenderbest outlet during 1H FY2022, the Group will continue to look for suitable expansion opportunities and create unique dining experiences for different markets in Singapore.

Future Prospect

Kimly’s directors stated that Tenderfresh Group in Oct 2021 was performed well and started to make contribution to the Group’s revenue. FY2021 was an eventful year. The management believes the corporate developments in FY2021 have laid a strong foundation for the Group to grow as well as equip the Group with more capabilities to better serve their customers.

Moving forward, the group will stay focused in carrying its four-pronged growth strategy to drive growth which include expanding footprint, diversifying product offering and revenue channels, expanding food retail division and strengthening operation capabilities to improve efficiency and productivity. As uncertainties persists, the group will keep a close watch on the Covid-19 situation and adjust their strategy accordingly to thrive in the ever-evolving landscape.

Fundamental Analysis

Market Cap: SGD435.104mil

Number of Shares: 1,243,154,000

PE Ratio: 11.076

EPS (SGD): 0.03160

Dividend Yield: 3.831%

Return on Equity: 23.594%

Technical Analysis

Resistance Level: SGD0.420, SGD0.365

Support Level: SGD0.335, SGD0.330

From the stock weekly chart of Kimly (1D0), Kimly has broken the recent key support price level of 0.365 and is also below the 200 moving average, which could indicate the beginning of the long term downtrend. The next key support level to pay attention to is 0.335. However, a bullish trend might continue if Kimly managed to reclaim 0.365 and rally towards the 0.420 resistance level.

![]() Please like and follow our FB page to get more updates from us. Thank you.

Please like and follow our FB page to get more updates from us. Thank you. ![]()

![]() 𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

The research, information and opinion expressed in this article / video are purely for information and educational purpose only and should not be construed as investment advice. We will not be liable for any losses or damages suffered from your investment decisions. Kindly consult a licensed investment advisor if you wish to get any investment advice.

![]() Open a Stock / Futures trading account in Malaysia: https://bit.ly/3dX157y

Open a Stock / Futures trading account in Malaysia: https://bit.ly/3dX157y

🍁 Facebook:https://www.facebook.com/mywealthfort

🍁 Instagram:https://www.instagram.com/mywealthfort/

🍁 Telegram:https://t.me/mywealthfort

🍁 YouTube:https://www.youtube.com/lifechamp

🍁 Website:https://www.mywealthfort.com/

More articles…