Background

Keppel DC REIT was listed on the Singapore Exchange on 12 December 2014 as the first pure-play data centre REIT in Asia.

Keppel DC REIT is sponsored by Keppel Telecommunications & Transportation Ltd (Keppel T&T), a wholly-owned subsidiary of Keppel Corporation Limited. It is managed by Keppel DC REIT Management Pte Ltd (the Manager), a wholly-owned subsidiary of Keppel Capital Holdings Pte Ltd (Keppel Capital). Keppel Capital is a premier asset manager in Asia with a diversified portfolio in real estate, infrastructure, data centres and alternative assets in key global markets through its listed REITs and Trust, as well as private funds. The Keppel Group, through Keppel T&T and the private data centre funds has currently over $2bil worth of data centre assets under development.

The Manager’s key objectives are to provide Keppel DC REIT’s Unitholders with regular and stable distributions, as well as achieve long-term growth through at least 90% of its AUM in data centre investments, while maintaining an optimal capital structure.

Business Model

Keppel DC REIT’s investment strategy is to principally invest, directly or indirectly, in a diversified portfolio of income producing real estate assets which are used primarily for data centre purposes, as well as real estate and asset necessary to support the digital economy.

Keppel DC REIT’s investment comprises an optimal mix of colocation, fully-fitted and shell and core assets, as well as network assets through its investments in debt securities, thereby reinforcing the diversity and resiliency of its portfolio.

Before we look into the Keppel DC REIT 3Q2022 results, let me share with you some of the basic knowledge about REITs.

What are the benefits of investing in listed REITs?

Affordability

Investments in REITs cost a fraction of the cost of direct investment in real investment in real estate. You can start off with a minimal investment outlay.

Liquidity

REITs are more liquid compared to physical properties. Units of listed REITs are readily converted to cash as they are traded on the stock exchange.

Stable Income Stream

REITs tend pay out steady incomes (similar dividends), which are derived from existing rents paid by tenants who occupy the REITs’ properties.

Exposure to large-scale real estate

You can derive the benefits of the real estate on a pro-rated basis through a REIT, a quality investment which is affordable.

Professional Management

You benefit from having the REIT and its underlying assets managed by professionals who will add value for a higher yield.

What kind of returns can be expected from REITs?

Typically, the returns to unit holders of a REIT can be in the form of:

* Income distribution based on the distribution policy stated in the REIT’s deed

* Capital gains which may arise from appreciation of the REIT’s price

*Distribution yield: The yield is normally published in the business section of major daily newspaper. It is derived from the following formula:

Distribution yield = Income distribution paid to a REIT unit holder / REIT’s price paid by the unit holder (or the prevailing market price of the REIT)

What are the risks of investing in REITs?

Market Risk

REITs are traded on the stock exchange and the prices are subject to demand and supply conditions. The price generally reflects investors’ confidence in the economy, the property market and its returns, the REIT management, interest rates, and many other factors.

Income Risk

Distributions are not guaranteed and are subject to fluctuations in the REIT’s income. For example, a REIT’s rental income may be affected if tenancy agreements could be renewed at a lower rental rate than before or the occupancy rate could fall.

If the underlying properties are financed by debts, there is a refinancing risk when cost of debt varies. A higher cost of debt may also reduce the income distributions to unit holders.

Liquidity Risk

A REIT may find it difficult to find buyers and sellers for its properties. It may be difficult for REITs to vary their investment portfolio or sell its assets on short notice under adverse economic conditions or exceptional circumstances.

Leverage Risk

Where a REIT uses debt to finance the acquisition of its properties, there is leverage risk. If the REIT is wound up, its assets will be used to pay off creditors first. Any remaining value will then be distributed to unit holders.

Now let us look into Keppel DC REIT 3Q2022 results together.

Keppel DC REIT 3Q2022 Results:

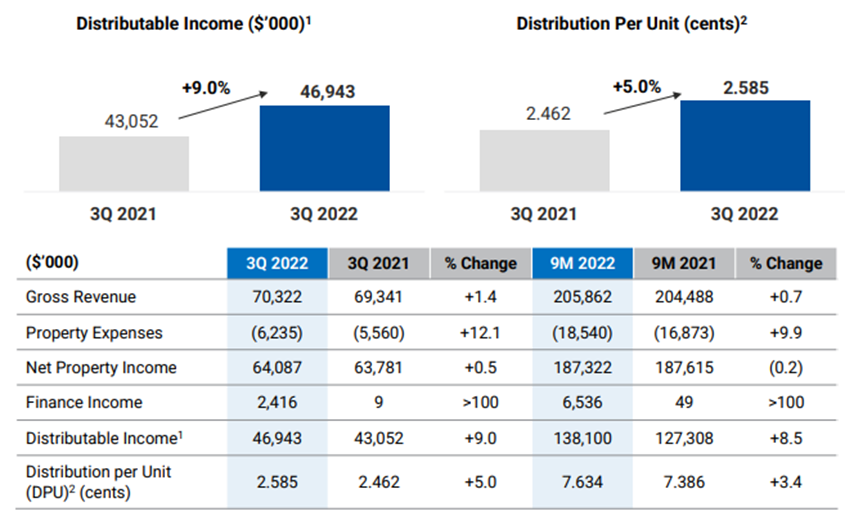

Keppel DC REIT has achieved a higher distributable income and DPU of S$0.02585 which were mainly due to the contributions from the acquisitions of Guangdong Data Centre 1,2 & 3 (Premises), London Data Centre and Eindhoven Campus.

The increase in gross revenue of the group was partially offset by the net lower contributions from some of the Singapore colocation assets (facilities expenses including electricity costs & provision relating to DXC), depreciation of EUR, AUD and GBP against SGD and divestment of iseek Data Centre.

The higher property expenses were mainly due to higher property related expenses at the Dublin assets following AEI completion. While the higher finance income was mainly due to interest income from NetCo Bonds and coupon income from Guangdong Data Centre 3.

Keppel DC REIT has a very strong portfolio occupancy as it was riding on the continued strong demand for data centres in all the markets. The group’s portfolio occupancy improved further to 98.6% which was mainly due to the inclusion of the master-leased Guangdong Data Centre 2 and Data Centre 3, as well as higher occupancy at Keppel Data Centre Dublin 1. There are only 2.6% of portfolio leases remain to be renewed in 4Q2022, and a further 13.3% of leases are due in FY2023.

On a year-to-date basis, Keppel DC REIT’s all-in financing costs increased to 2%. On Q-o-Q basis, financing costs likely increased 30bps to 2.3%. There is a 74% of loans remains hedged to fixed rates and this will help to partially mitigate the impact from the rise in interest rates.

Keppel DC REIT’s gearing remains healthy at 37.5%. The higher gearing is mainly due to additional debt drawn down to fund Phase 1 of Guangdong Data Centre 2 and Data Centre 3 acquisition. The Phase 2 of the Guangdong Data Centre acquisition will only happen in 3Q2023. This gives the flexibility to fund Phase 2 either through a combination of debt and equity, or entirely on debt. If Phase 2 is funded entirely through debt, gearing is still expected to remain healthy at 39%. There is only 2.6% of loans due to mature in 4Q2022, and a further 11.1% are due in FY2023.

Although 40% of Keppel DC REIT’s earnings are earned in foreign currencies, its FX hedges help to minimize any volatility in earnings. Keppel DC REIT adopts a forward 2 years rolling FX hedge policy. The earnings today benefit from the FX rates that were locked in approximately 24 to 18 months prior.

Future Prospects

According to the management, the world’s data needs continue to grow exponentially, albeit growth in key data centre hubs may be limited by power and land availability. Asia Pacific is set to become the world’s largest data centre region over the next decade, fueled by demand from hyperscalers and governments.

The 1H2022 data centre demand in Europe (Frankfurt, London, Amsterdam, Paris, Dublin) has surpassed 2021 total, underpinned by the hyperscaler demand. Moreover, the tightening government regulations around sustainability leads to limits on new data centre supply whilst regulations on data privacy and national sovereignty creates more demand for data centres.

Technical Analysis

Resistance Level: SGD2.07, SGD1.94

Support Level: SGD1.60

Current Share Price: SGD1.79

According to the weekly charts of Keppel DC Reit (AJBU), the stock recently formed a new support and has been trading above the price level of 1.60. However, AJBU is currently still below the SMA 200 and also in a long-term down trend. A price breakout of 1.94 and continued sustained above 2.07 is a good indicator of a reversal uptrend.

![]() Please like and follow our FB page to get more updates from us. Thank you.

Please like and follow our FB page to get more updates from us. Thank you. ![]()

![]() 𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

The research, information and opinion expressed in this article / video are purely for information and educational purpose only and should not be construed as investment advice. We will not be liable for any losses or damages suffered from your investment decisions. Kindly consult a licensed investment advisor if you wish to get any investment advice.

More articles…