Background

UG Healthcare Corporation Ltd is a disposable gloves manufacturer with its own established global downstream distribution that markets and sells disposable glove products under its proprietary “Unigloves” brand.

The Group owns and operates an extensive downstream network of distribution companies with a local presence in Europe, United Kingdom, USA, China, Africa and South America, where it markets and sells its own proprietary “Unigloves” brand of disposable gloves.

UG Healthcare is listed on the Catalist Board of the Singapore Exchange Securities Trading Limited on 8 December 2014 under stock code 8K7.

Business Model

The Group’s strategy has always been to cultivate demand for its proprietary “Unigloves” range of disposable gloves through their downstream distribution companies.

The Group also distributes ancillary products including surgical gloves, vinyl and cleanroom disposable gloves, face masks and other medical disposables. These downstream distribution companies are supported and complemented by the Group’s own upstream manufacturing division, manufacturing natural latex and nitrile disposable gloves under its “Unigloves” brand and third-party labels in its manufacturing facilities located in Seremban, Negeri Sembilan, Malaysia.

Its “Unigloves” brand of disposable gloves offers an extensive product range that includes both specialised products, with a variety of coatings, scents, colours, thickness, anti-microbial properties for more specialised users, as well as generic products. These products are used across a diverse range of industries requiring cross infection protection and hygiene standards, whilst catering to different applications and preferences.

Management Background

Mr. Yip Wah Pung, Non-Executive Chairman and Independent Director

Mr. Yip Wah Pung is the Non-Executive Chairman and Independent Director of the Company, Chairman of the Audit Committee and a member of the Nominating and Remuneration Committees. He was appointed to the Board on 20 November 2014 and was last re-elected on 24 October 2019. Mr. Yip has over 40 years of experience in the audit and tax industry. He started his career as a tax examiner at the Income Tax Department of Malaysia in February 1977, where he worked for 12 years. From February 1989 to August 1989, he joined W.M Lam & Co, an audit firm, as a senior associate. Subsequently, he joined K.W. Chong & Co as an audit manager from September 1989 to November 1994 before he started his own audit firm, W.P. Yip & Co in 1994, where he is currently a partner. The audit firm is principally engaged in the provision of tax and audit services. Mr. Yip graduated from Tunku Abdul Rahman College with a diploma in Commerce in June 1977. He has been a member of (i) the Malaysian Institute of Accountants since 1980, (ii) the Association of Chartered Certified Accountants since 1980, (iii) the Malaysian Institute of Chartered Secretaries and Administrators since 1980, and (iv) the Chartered Tax Institute of Malaysia since 1995.

Mr. Lee Keck Keong Executive Director and Chief Executive Officer

Mr. Lee Keck Keong is the Executive Director and Chief Executive Officer of the Company. He is a member of the Nominating Committee. He was appointed to the Board on 20 November 2014 and was last re-elected on 24 October 2019. Mr. Lee has been instrumental in successfully leading the Group to become an established player in the gloves manufacturing industry. He also serves as a director to the boards of the Company’s subsidiaries and associated companies. Mr. Lee graduated from the University of Surrey in 1977 with a degree in chemical engineering. Upon graduation, he started his career as a chemical engineer in a state-owned company. Thereafter, he entered into various business ventures in diverse industries, including mining, saw milling, property development and timber development.

UG Healthcare Posted S$36.8mil Net Profit for FY2022

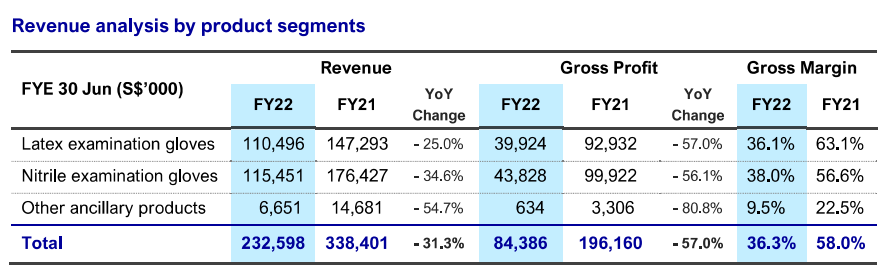

The Group recorded lower revenue and gross profit in FY22 on the back of rapid decline in the ASP across all product segments as a result of the increase in market supply of disposable examination gloves, and customers’ preference to hold lower inventory in view of the downtrend in the ASP.

In the financial year under review, production volume of disposable examination gloves produced at the Group’s upstream manufacturing increased gradually after its manufacturing facilities and workforce capacity fully resumed. However, sales revenue in key markets were affected as the Group continued to face delays in shipment of products and slower sales as customers preferred to hold lower inventory.

Gross profit decreased by 57.0% year-on-year from S$196.2 million in FY21 to S$84.4 million in FY22. This was in tandem with lower revenue arising from lower ASP across all product segments, which was partially offset by lower raw material prices despite an increase in production volume. Correspondingly, gross profit margin declined from 58.0% in FY21 to 36.3% in FY22.

Other income decreased by 42.8% year-on-year from S$1.3 million in FY21 to S$0.7 million in FY22 as a foreign exchange loss was recognised in FY22. Other expenses increased from S$0.6 million in FY21 to S$2.4 million in FY22 mainly due to foreign exchange loss arising from the volatility of the functional currencies of the Group’s distribution subsidiaries, namely the Brazilian Real, the Renminbi and the British Pound against the US Dollar.

Total operating expenses comprising marketing and distribution expenses and administrative expenses decreased by 17.7% year-on-year from S$40.4 million in FY21 to S$33.2 million in FY22. The reduction stemmed from the decrease in administrative expenses as (i) groupwide staff bonuses and commission were reduced in tandem with the decline in revenue and profit, and (ii) additional costs and service charges relating to the implementation of strict precautionary measures against Covid-19 infection had declined.

Finance costs increased by 33.3% year-on-year from S$0.6 million in FY21 to S$0.8 million in FY22, due to the increase in long-term borrowings for the construction of the new factory and production lines for the additional capacity of 1.2 billion pieces of gloves per annum, as well as an increase in interest rate.

Share of profits from associates saw a significant decline from S$3.6 million in FY21 to S$0.1 million in FY22 due to lower profits reported by its associates in Germany and the USA, as a result of the decrease in the ASP of gloves. After taking into account tax expenses and minority interests, the Group’s net profit attributable to shareholders declined from S$118.8 million in FY21 to S$36.8 million in FY22.

The Group strengthened its balance sheet in FY22 with net asset value increasing from S$190.6 million as at 30 June 2021 to S$228.9 million as at 30 June 2022. Correspondingly, net asset value per share increased from S$0.3093 as at 30 June 2021 to S$0.3669 as at 30 June 2022. The Group also maintains a strong net cash position of approximately S$83.8 million as at 30 June 2022.

Taking into consideration the global economic slowdown and geopolitical uncertainties, the Board is of the view to conserve cash resources for the Group’s future expansion. The Board has proposed a special dividend of 0.32 Singapore cents per share and a final dividend of 0.32 Singapore cents per share for FY22 as a token of appreciation to shareholders. The total dividend of 0.640 Singapore cents for FY22 is a slight increase from 0.611 Singapore cents in FY21.

Future Prospect

The increase in the global supply of disposable or single-use gloves over the past two years intensified competition and led to the rapid decline in the average ASP -Covid levels despite relatively strong global demand for gloves. Nevertheless, greater awareness of the need for hand protection for safety and hygiene purposes is likely to continue to drive global demand for disposable gloves as countries progress to the endemic phase.

The commencement of the new production capacity of 1.2 billion which was originally to be scheduled in May is delayed by the shortage of manpower. While the Group has recently obtained the relevant approval to recruit foreign workers, the new employees are expected to arrive progressively from October 2022. Hence, the additional capacity of 1.2 billion pieces of gloves per annum could likely be commissioned from October 2022 onwards.

Amid the disequilibrium in the demand-supply of disposable gloves, the global economic slowdown and geopolitical uncertainties, the Group remains mindful of further expansion in disposable gloves production beyond its current total installed production capacity of 4.6 billion pieces per annum in the near future. Nevertheless, the Group is confident that its current total installed production capacity is adequate to satisfy the demand for its proprietary UNIGLOVES® branded disposable glove products.

The group will also harness its strengths through its integrated own brand manufacturing (OBM) foundation to cultivate demand for its range of proprietary branded reusable gloves for users in heavy industry, and thereby, broaden its earnings base progressively. The OBM model will also enable the Group to achieve long term sustainable growth as it continues to seek non-glove investment opportunities in the healthcare related sector as part of its product portfolio expansion strategy.

Fundamental Analysis

Market Cap: S$109.79mil

Number of Shares: 623.83mil

PE Ratio: 2.98

EPS (SGD): 0.059

Dividend Yield: 1.818%

Return on Equity: 16.075%

Technical Analysis

Resistance Level: S$0.250, S$0.205

Support Level: S$0.044

Based on the weekly chart of UG Healthcare, UG Healthcare has broken a recent formed support price level of S$0.205 and is also below the 200 Simple Moving Average (SMA), continuing the long term down trend. UG Healthcare might continue to plunge further until it manages to explore the next new support level. A bullish reversal view for UG healthcare is established when prices reclaim the 0.205 price level and subsequently stand firm above the S$0.250 price level.

![]() Please like and follow our FB page to get more updates from us. Thank you.

Please like and follow our FB page to get more updates from us. Thank you. ![]()

![]() 𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

The research, information and opinion expressed in this article / video are purely for information and educational purpose only and should not be construed as investment advice. We will not be liable for any losses or damages suffered from your investment decisions. Kindly consult a licensed investment advisor if you wish to get any investment advice.

📌 Open a Stock / Futures trading account in Malaysia:https://bit.ly/3dX157y

Facebook:https://www.facebook.com/mywealthfort

Instagram:https://www.instagram.com/mywealthfort/

Telegram:https://t.me/mywealthfort

YouTube:https://www.youtube.com/lifechamp

Website:https://www.mywealthfort.com/

More articles….