Background

G.H.Y Culture & Media Holding Co. Ltd is an entertainment business that focuses on the production and promotion of dramas, films and concerts in the Asia-Pacific region. GHY has produced numerous dramas and films in the People’s Republic of China (“PRC”), Singapore and Malaysia that have been broadcasted and/or distributed on major TV networks and leading video streaming platforms in the region. The Group has also undertaken the production of concerts for well-known international artistes in Singapore, with upcoming concerts to be held in Malaysia and Australia.

GHY has strong in-house production teams, including but not limited to executive producers, directors and scriptwriters, who have been involved in various notable dramas and films. The production teams have consistently produced quality dramas and films and the Group also possesses expertise and capabilities across the business value chain.

Currently headquartered in Singapore and the PRC with over 170 employees, the Group also engages in concert production, talent management services, and costumes, props and make-up services.

Business Model

TV Program and Film

Production

• Producer and co-producer of high-quality TV and web dramas and films

broadcasted and/or distributed on major TV networks and leading video streaming

platforms in the region (e.g. CCTV, iQIYI, Youku, Kuaishou, Tencent Video, Douyin/Tiktok)

• Established production teams of experienced directors and producers in both the PRC and Singapore

Concert Production

• Organiser of concerts for well-known international artistes in Singapore, with

upcoming concerts in Malaysia and Australia

• Involved in production of concerts in the PRC

• Established concert production teams in both Singapore and the PRC

Costumes, Props, and Make-up Services and Talent Management Services

• Provision of costumes, props and make-up services for drama and film production activities

• Exclusive collaboration with award-winning costumes and props designer, Chen Minzheng

• Provision of talent management services to more than 60 artistes primarily based in the PRC and/or Singapore

Management Background

Mr. Guo Jingyu (郭靖宇), Executive Chairman and Group CEO

Mr. Guo Jingyu is the Executive Chairman and Group CEO and was appointed to the Board of G.H.Y Culture & Media on 29 May 2018. Mr. Guo is responsible for supervising the overall business operations and management of the Group, where he oversees the Group’s long-term business strategies and provides executive leadership and supervision to the senior management team. Mr. Guo is also responsible for the overall direction and production of the drama, film and online video series produced by the Group. Mr. Guo has close to 30 years of experience in the entertainment industry and is well known as a prolific and award-winning director, producer and scriptwriter. To date, he has earned 17 nominations and 13 wins at the “China Television Director Committee Awards” for his TV series.

Prior to G.H.Y Culture & Media, Mr. Guo was a Director, Producer and Scriptwriter with Perfect World, an entertainment company listed on the Shenzhen Stock Exchange which business includes TV program and film production, from March 2011 to December 2018. Mr. Guo graduated from Hebei Art School with a Certificate in Drama in 1993 and is currently a member of the Youth Committee of China Television Drama Production Industry Association.

GHY Culture & Media – 1H2021 Results Below Expectations; Stay Tuned For a Better 2H

GHY Culture & Media’s net profit declined to S$3.5mil (-73% YoY) in 1H2021. Excluding one-off adjustments as well as the concerts segment, 1H2021 net earnings would have been down 14% YoY. This was mainly due to the appreciation of SGD against RMB arising from the Group’s significant operations in China. Core drama revenue rose on a YoY basis; unfortunately, the effects of COVID-19 measures cause margins to dip.

While the Group recognised revenue contribution mainly from the completed production of three long-dramas, the tightened COVID-19 measures in China significantly delayed the Group’s contract signing and production progress, resulting in a decrease in revenue contribution from the TV Program and Film Production business segment, as well as from the Others business segment mainly comprising Talent Management and Costumes, Props and Make-up Services. The continued absence of revenue contribution from the Concert Production business in 6M2022 also continued to impact the Group’s financial performance.

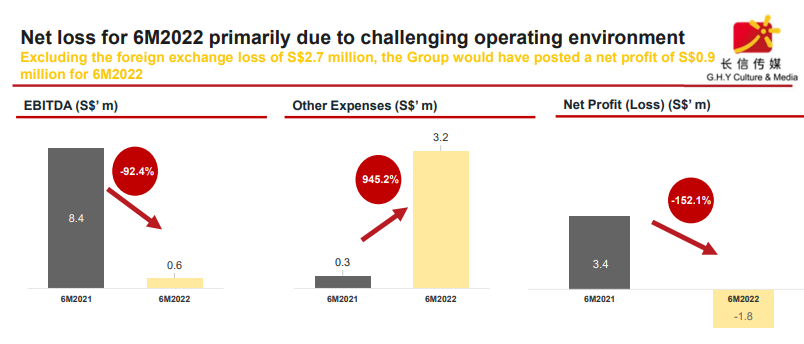

The appreciation of Singapore Dollar against Chinese Renminbi led to a net foreign exchange loss of S$2.7 million for 6M2022. As a result, the Group recorded a net loss for the period of S$1.8 million for 6M2022. Excluding the net foreign exchange loss recognised, the net profit for 6M2022 would have been S$0.9 million.

Strong second half expected with an upcoming slate of drama and projects

The Group continues to maintain a healthy pipeline of dramas and films, and demand for its high quality short-form video series continues to grow. On 12 July 2022, GHY announced that its indirect associated company had entered into a production collaboration agreement with Beijing Zitiao Network Technology Co., Ltd. (北京字跳网络技术有限公 司), which is part of the ByteDance group that operates Douyin (抖音) (the Chinese version of TikTok, a short-form video platform) to collaborate and produce an online short-form drama series titled “Goddess Hotel 女神酒店”. The series has received strong viewership on Douyin for the episodes released till date. Barring any unforeseen circumstances, the Group expects an increase in production activity of long-form dramas and several short-form video series in the second half of 2022.

The increased production activity resulted in a steady increase in the Group’s other receivables from approximately S$15.4 million as at 31 December 2021 to S$17.5 million as at 30 June 2022, mainly due to prepayments made for upcoming drama productions and government grant receivables. These grant receivables are received in July 2022.

Contract assets, which represent the Group’s right to consideration for drama and film productions in progress but unbilled, also grew by 0.6% to approximately S$59.7 million as at 30 June 2022.

Revenue declined S$23.2 million or 52.9% to S$20.6 million in 6M2022 mainly due to COVID-19-induced delays in contract signings.

• Contract signings with some customers were delayed due to COVID-19 measures in China hence fewer titles were sold in current period;

• Revenue recognised mainly from the completed production of three dramas named “Horror Stories of Tang Dynasty唐朝诡事录”,“Sisterhood 南洋女儿情“ and ”A Fish and A Cat 骑着鱼的猫“ in 6M2022 and sale of a script “Misty Rain 烟雨”;

• Anticipates a good pipeline of film and drama content in the second half of this year (“2H2022”);

• Short-form video production named “Goddess Hotel 女神酒店” was a popular hit on Douyin (抖音) (also known as TikTok), topping the search list of Douyin. The Group will recognise the revenue and costs in 2H2022; and

• Resumption of concert production activities with upcoming concerts in Singapore, Malaysia and Australia by popular and well-known artistes, including singer-songwriter, Jay Chou, in December 2022, January 2023 and March 2023.

Corresponding to lower revenue in 6M2022, gross profit declined S$7.3 million or 59.3% to S$5.0 million.

• Impacted by significant disruptions of filming and production activities due to the COVID-19 lockdown in Shanghai where filming duration for “Sisterhood 南洋女儿情” was extended from March 2022 to May 2022. “Sisterhood 南洋女儿情” remained profitable; and

• No ongoing or planned on-site filming activities in other cities in China that are affected by the current lockdown measures.

EBITDA decreased by S$7.8 million from S$8.4 million in 6M2021 to S$0.6 million in 6M2022

• Contract signings with some customers were delayed due to the COVID-19 lockdown in China and hence, fewer titles weresold in 6M2022; and

• Approximately $2.7 million in net foreign exchange loss primarily due to appreciation of the Singapore dollar against Chinese Renminbi arising from the Group’s significant operations in China; offset by

• Increase in government grants and reversal of allowance of credit loss as these trade receivables for the relevant projects were collected in 6M2022.

Preparation to ramp up business activities in the second half of 2022

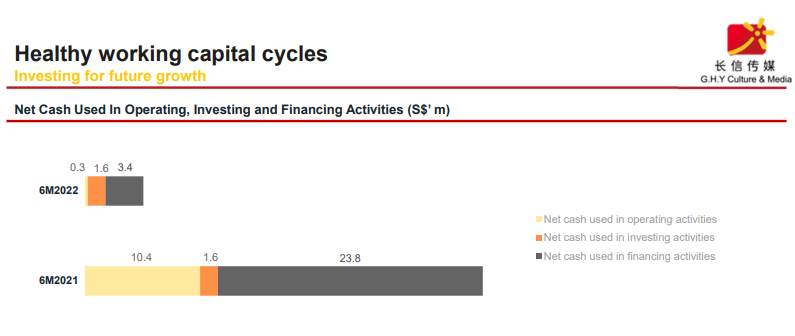

• Net cash used in operating activities for ongoing drama and concert productions, offset by receipts for drama productions;

• Net cash used in investing activities for addition of a film set located in China for filming purposes; and

• Net cash used in financing activities for payment of final dividends in respect of FY2021, payment of lease liabilities and shares repurchased in 6M2022.

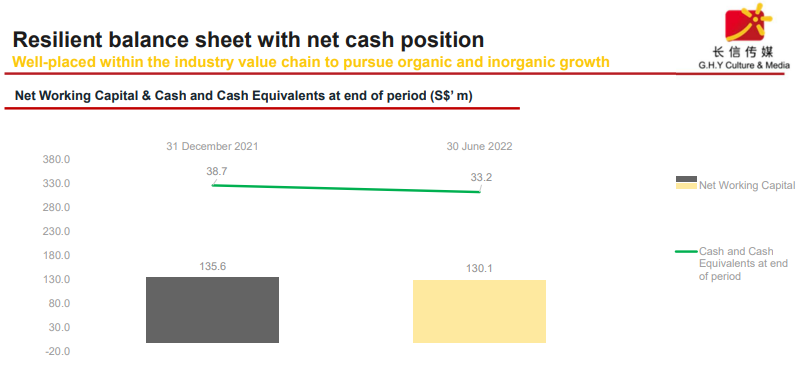

Maintains a net cash position of S$19.3 million

• To be used for dramas and film productions, concert productions and working capital purposes; and

• Net cash position of S$19.3 million enhances the Group’s business agility within the industry value chain to strategically pursue organic and inorganic growth in order to enhance stakeholders’ value.

Futures Prospect

Resumption of concert production business

Following the further easing of COVID-19 measures and the resumption of live performances in the region, GHY has undertaken the production of the “Jay Chou Carnival World Tour” concerts (周杰伦《嘉年华》世界巡回会), which are slated to be held on 17 December 2022 and 18 December 2022 at the National Stadium, Singapore, as well as in Malaysia and in Australia in 2023. To capture the pent-up demand for concerts, GHY is also the co-producer of the upcoming concerts to be performed by well-known artistes, Power Station (动力火车) and Guns N’ Roses, which are expected to contribute to the Group’s revenue for FY2022.

Multi-prong growth adjacencies supported by a robust balance sheet

The Group intends to continue expanding its portfolio of entertainment content and products, with diversification into new growth adjacencies such as musicals and its first-ever immersive live action game based on GHY’s “Horror Stories of Tang Dynasty” drama series. Supported by a robust balance sheet with a net working capital of approximately S$130.1 million as at 30 June 2022, the Company believes that the Group is well-positioned to capture organic and inorganic growth initiatives, to capture the recovery and bring sustainable long-term returns to shareholders.

Fundamental Analysis

Market Cap: 444.4mil

Number of Shares: 1,069,687,000

PE Ratio: 114x

EPS (SGD): 0.00364

Dividend Yield: 0.241

Technical Analysis

Resistance Level: SGD0.600, SGD0.480

Support Level: SGD0.395

From the stock weekly chart of GHY CULTURE(XJB), the XJB is below the 200 moving average, continuing the long term down trend. A bearish view for XJB persists if the price breaks the next support level of SGD0.395. Alternatively, if the price manages to reclaim SGD0.480 and approaches SGD0.600, it might indicate the price is reversing and the trend is turning bullish.

![]() Please like and follow our FB page to get more updates from us. Thank you.

Please like and follow our FB page to get more updates from us. Thank you. ![]()

![]() 𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫:

The research, information and opinion expressed in this article / video are purely for information and

educational purpose only and should not be construed as investment advice. We will not be liable for any losses or damages suffered from your investment decisions. Kindly consult a licensed investment advisor if you wish to get any investment advice.

📌 Open a Stock / Futures trading account in Malaysia: https://bit.ly/3dX157y

Facebook: https://www.facebook.com/mywealthfort

Instagram: https://www.instagram.com/mywealthfort/

Telegram: https://t.me/mywealthfort

YouTube: https://www.youtube.com/lifechamp

Website: https://www.mywealthfort.com/

More articles…